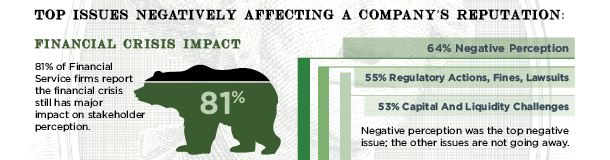

Makovsky, a communications company, recently interviewed 225 executives from banks, credit card companies, mutual funds, and other financial services providers about their outlook on Wall Street. The study showed that “81% of Financial Service companies continue to struggle with reputational and customer service issues stemming from the financial crisis six years ago.”

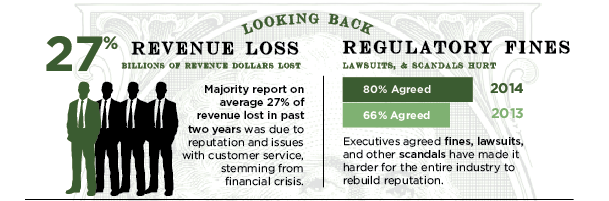

Almost 40% of those interviewed believed that Wall Street is riskier today than it was before the financial crisis, which raises questions about the permanence of the scars the financial crisis left on financial services providers. This drop in reputation is, at least partially, due to new regulations under the Dodd-Frank Act as well as fines and lawsuits that have hurt the image of corporations and caused them to lose business. Some, on the other hand, believe that the stricter regulations are just what the industry needs in order for corporations to regain customer trust.

The study also revealed that the negative perception customers have toward financial services corporations is largely impacting sales; the companies interviewed showed an average business loss of 27% (which in this industry means billions of dollars).

According to Scott Tangney, the executive vice president of Makovsky, “this sour climate is here to stay for the foreseeable future because the majority of executives believe it will still take up to five more years to restore their company’s reputation to prefinancial crisis levels.” As the study revealed, the No. 1 challenge that corporations in the financial services industry are facing is overcoming the negative perception created by the financial crisis six years ago.

Figure 1

Source: Makovsky Integrated Communications available here.

Wall Street Reputation Continues to Suffer, According to Recent Study (PDF)