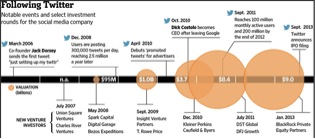

Twitter, Inc. publicly filed its IPO documents on Thursday, revealing the microblogging company’s financials for the first time. Analysts expect the seven-year-old site to be valued in the $10- to $15-billion range, although it is still unprofitable. Rapid growth has been outmatched (for now) by accelerated expenses: in the first half of this year, revenue doubled to $254 million but net loss increased by 40% to $69 million. Twitter, which has chosen the ticker symbol TWTR, is still behind the pace set by Facebook. By comparison, Facebook’s IPO sales pitch showcased a $1 billion annual profit in 2011 and 845 million active users (Twitter has 215 million). Twitter’s co-founder and former CEO Evan Williams will expect the largest payout once the liquidity event is completed; he owns 12 percent of the company. Co-founder Jack Dorsey owns 4.9 percent.

The federal government is paralyzed as lawmakers have failed to agree on the nation’s budgetary priorities. Divided government in hyper-partisan Washington, D.C., has proven to be a recipe for stalemate. While most of the coverage has focused on House Republicans’ objection to funding the Affordable Care Act, the debate will likely be viewed as a much broader battle on federal spending. Two storms will soon converge—the current battle over a Continuing Resolution (essentially legislative authorization to write certain checks from the U.S. Treasury) and the imminent necessity to raise the federal government’s $16.7 trillion debt ceiling (to further add to the nation’s debt). Treasury Secretary Jack Lew has estimated that the U.S. government will need to raise the ceiling before October 17th, less than two weeks away. For lawmakers, resolving the current shutdown by passing a “clean CR” will solve little unless the deal also addresses the debt ceiling—thus, the conversation for congressional leaders of both parties appears to have shifted to a grand bargain or large-scale budget deal. For now, Wall Street has remained mostly apathetic, but prolonged brinksmanship is likely to change the market’s attitude in a hurry.