Sprint and T-Mobile, the nation’s third- and fourth-largest wireless phone operators, are now fully engaged in merger talks. Following the AT&T/DirecTV and Comcast/TWC merger, this is set-up to be the third largest telecommunications deal in the past three years, and perhaps the last big deal of its kind for the near future. The planned merger would be the 18th largest deal in the telecommunications industry since 1984.

The Deal Terms

It appears that the two parties have reached agreement on a $32 billion deal, rumored to be announced later this summer. The deal provides that Sprint would acquire T-Mobile for about $40 a share, in a mix of cash and stock.

The deal was perhaps motivated by the other large mergers in the industry, where competitors such as Verizon (taking full control of Verizon Wireless in a $130 billion deal with Vodafone) and AT&T (recently acquiring DirecTV in a $49 billion deal) continue to grow through acquisitions. Sprint and T-Mobile had to jump onboard the merger train or be left behind.

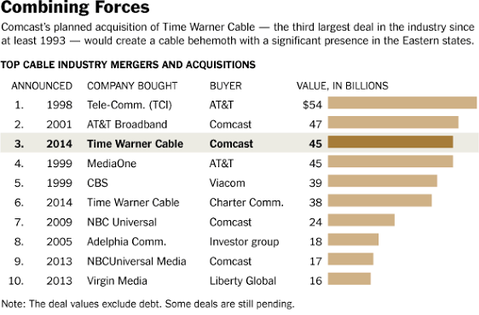

AT&T previously attempted to acquire T-Mobile, but the deal was blocked by regulators. AT&T then turned its attention to television, making an offer for DirecTV. These recent deals have blurred the lines between telephone, Internet, and television companies, with Comcast/TWC leading the charge. (See Figure 1).

Effect of the Merger on the Market

Sprint’s deal for T-Mobile has not yet officially been announced. And, as AT&T/DirecTV and Comcast/TWC well know, the road to regulatory approval is long. If these three deals are approved however, according to The New York Times, “the wireless industry – having shrunk from six major carriers to three in a matter of years – is unlikely to change much more anytime soon.”

Effect of Multiple Mergers on Regulatory Approval

Regulators are now faced with multiple telecommunications merger to approve or reject. Will the fact that all of these major deals are going up for approval at the same time help or hurt the mergers? That remains to be seen. Walter Piecyk, an analyst at BTIG Research, commented that “regulators have many deals in front of them and need to consider where the market will be five years from now and how to best stimulate competition, which not only means lower prices but also more investment.” Some, like Craig Moffett, the senior research analyst for MoffettNathanson, are not optimistic about the deal’s chances. Moffett was cited saying: “I don’t think you can put more than a 10 percent chance of success for this deal.”

In order to account for the uncertainty that comes along with regulatory approval, the proposed deal includes a $1 billion clause, where Sprint would pay T-Mobile if the deal is not approved.

As always, consumers are most concerned with a merger of this magnitude. Consolidation of some of the nation’s largest wireless carriers removes competition from the market, which could lead to higher prices and less accountability to consumers.

Figure 1 Source: The New York Times

For “Consumers v. Big Business Part I: AT&T and DirecTV,” click here.

For “Consumers v. Big Business Part II: Comcast and Time Warner Cable,” click here.

Consumers v. Big Business Part III: Sprint and T-Mobile (PDF)