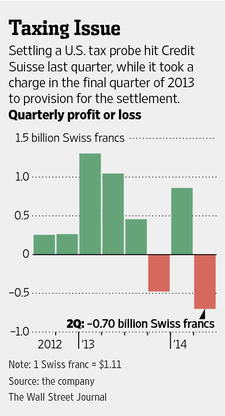

Zurich-based investment bank, Credit Suisse, recently reported a second-quarter loss of 700 million Swiss francs (779 million dollars)—the bank’s largest lost since the financial crisis in 2008. The loss stands in contrast to the bank’s net profit of 1.05 billion francs in the previous year. The loss is the aftershock of a settlement Credit Suisse reached with the United States in May by pleading guilty to one count of conspiring to aid tax evasion. The bank was helping Americans hide their money in Swiss accounts in order to avoid paying U.S. taxes. As a result, Credit Suisse agreed to pay $2.6 billion in penalties. In regards to the bank’s recent legal issues, Brady Dougan, the bank’s Chief Executive Officer in the U.S., said that “there is no issue that has taken more of [the bank’s] time over the past five to six years.”

Once a legal settlement was agreed upon, the bank expected that it would suffer a financial loss; at the time, bank executives predicted that the settlement would shave off $1.8 billion from the bank’s second-quarter profit. However, the settlement is not the only obstacle the bank has to overcome. The investment banking market has been in a downturn, which has affected the bank’s operations. Despite the financial downturn, the bank’s Chief Financial Officer, David Mathers, put out a positive image. According to Mathers, once the effect of the U.S. settlement is stripped out, the Swiss bank’s “strategic results [are] solid.” Dougan, however, appeared to better appreciate the settlement’s effects on the bank’s business, noting that as a result, “there may be clients that didn’t do business with [the bank], that would have [under other circumstances].”

What’s next for Credit Suisse? The large investment bank has announced that it will exit the commodities business and focus on restructuring its foreign exchange and rates business. Some analysts believe that Credit Suisse should follow the lead of UBS and Barclays, who are shrinking their fixed income business. However, Credit Suisse seems to instead join Deutsche Bank and Goldman Sachs in a bet that the market is in a cyclical downturn and will bounce back.

Credit Suisse Has Its Largest Loss Since the Financial Crisis (PDF)