Berkeley Law Professor Stavros Gadinis’s latest article, “From Independence to Politics in Financial Regulation,” is forthcoming in the California Law Review. Professor Gadinis’s work focuses on the intersections between finance and government regulation. This particular paper takes a global look at how governments reformed their “independent” financial regulatory agencies by making them more politically accountable after the 2007-08 financial crisis.

We at the Network found this article particularly interesting because it focuses on the fundamental—and often taken for granted—relationship between administrative law and business law. In the United States, “agency independence has long been the hallmark of financial regulation.” In fact, most governmental financial regulation occurs within the “headless fourth branch,” i.e., independent administrative agencies like the Federal Reserve (“the Fed”), Federal Deposit Insurance Corporation (“FDIC”), and Securities and Exchange Commission (“SEC”).

Historically, these governmental entities, corporations, boards, and commissions often have been insulated from direct democratic forces. The theory is that, free from “generalist” whims and electoral politics, agency independence allows neutral “subject matter experts” to focus their particular skill and knowledge on the specialized problems they were commissioned to solve. Further, independent agencies bring the country long-term stability and uniformity. Whereas elected politicians, so the theory goes, are often biased towards short-term goals to capture votes in the next electoral cycle.

When scholars speak of “independence” from political influence, they largely mean from the President’s removal power. It has long been settled that Congress may “under certain circumstances, create independent agencies run by principal officers appointed by the President, whom the President may not remove at will but only for good cause.” Free Enter. Fund v. Pub. Co. Accounting Oversight Bd., 561 U.S. __ (2010) (slip op. at 2).

However, too much independence can become a problem. For example, in Free Enterprise Fund the Supreme Court held that a dual for-cause removal scheme Congress set up in the Sarbanes-Oxley Act was ultra vires of the Constitution’s separation of powers. The Act placed members of the Public Company Accounting Oversight Board (“PCAOB”) under the SEC’s control, removable only for cause. In turn, SEC commissioners were only removable by the President for-cause. This novel structure, Chief Justice Roberts held, prevented the President from discharging his duty to “ensure that the laws are faithfully executed—as well as the public’s ability to pass judgment on his efforts.”

The anxiety that motivated Chief Justice Robert’s opinion in Free Enterprise Fund could partly be described as a fear of Congressional aggrandizement at the expense of the Chief Executive. But it could also be described as a distrust of the growing independence of democratically unaccountable bureaucrats—the same distrust that Professor Gadinis comments on in his most recent article.

Professor Gadinis argues that a coalescence of unique atmospheric factors post the 2007-08 crisis led to a global shift from financial regulatory independence toward greater political accountability. According to Professor Gadinis’s argument, those factors include (1) pervasive failures across multiple agencies charged with financial regulation, (2) failure of the market to self-correct, (3) fear of agency capture, (4) unprecedented voter interest, and (5) welcomed political assistance.

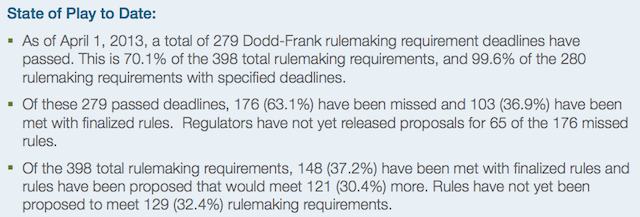

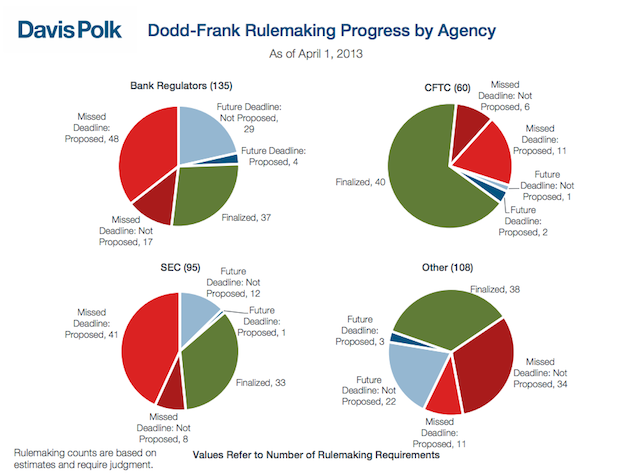

Professor Gadinis’s empirical data supports his premise in the United States, France, Germany, Australia, Belgium, Spain, Denmark, the United Kingdom and Ireland. Only a few countries surveyed did not evince an increase in political accountability, and that was because they either already had a highly politically accountable system or were in the process of working out legislation. In the United States, for example, one way this shift materialized was through the Dodd-Frank Act. Significantly, the move toward political accountability did not take the traditional route, e.g., Appointment and Removal powers. Instead, Congress sought to retain independent subject matter expertise, but at the same time make the Secretary of Treasury—who is directly accountable to the President—the final arbiter of agency decisions, rather than the agency head.

The upshot of all of this is that the administrative financial regulatory system in the United States, and likely worldwide has seen a paradigm shift. While this shift can simply be seen as moving independent agencies back within the traditional executive agency structure, it is important to remain cognizant of the hazards of too much political influence. After all, the benefits of the independence model are also the downsides of the political model. Professor Gadinis discusses how, in the bailout context, considerations of electoral timing, adverse public opinion detached from economic reality, and opportunities for massive political contributions could improperly influence political actors. Only time will tell where the line will be drawn in this canonical administrative law paradox.

Make sure to read the final version of the article in the California Law Review. The abstract is available after the jump. (more…)