After a secondary stock offering, Facebook officially joined the S&P 500, effective as of the close of trading on Friday, December 20. Facebook announced the secondary offering, consisting of 70 million shares of its Class A stock, on Thursday, December 19. Co-founder and CEO Mark Zuckerberg will sell 41.35 million shares; board member Marc Andreessen will sell 1.6 million shares; and Facebook is offering 27.05 million newly issued shares.

Facebook Officially Joins S&P 500

Senate Struggles to Craft Legislation on Fannie Mae and Freddie Mac

The Obama Administration has expressed support for a bipartisan bill to wind down government-controlled mortgage companies, Fannie Mae and Freddie Mac. The proposed bill will eliminate or greatly reduce the size of these companies while retaining the federal government’s role in backing mortgage lending. However, lawmakers seem unlikely to produce a bill by the end of the year as planned.

Summary of Selected Issues of the SEC Municipal Advisor Rule that Affect Broker-Dealers Intending to be Underwriters

Dodd Frank Act Definition of “Municipal Advisor”

A “municipal advisor” is a person (including a firm or an associated person) (but not including a municipal entity or an employee of a municipal entity) who (1) provides “advice” to “municipal entities” or “obligated persons” on the “issuance of municipal securities” or “municipal financial products,” or (2) undertakes a “solicitation of a municipal entity.”

Prospectus Disclosure Regime in Europe — the Proportionate Disclosure Regime and Supplementary Prospectuses

Regulators have recently clarified two important aspects of the prospectus regime that applies across the European Economic Area pursuant to the Prospectus Directive (Directive 2003/71/EC as amended by Directive 2010/73/EU). The Prospectus Directive provides the overarching European regulatory framework for the publication of prospectuses in connection with debt and equity securities being offered to the public or admitted to trading on regulated markets in the EEA.

SEC Proposes Rules on Crowdfunding

On October 23, 2013, the Securities and Exchange Commission (SEC) proposed rules which would, if adopted, govern the offer and sale of securities under new Section 4(a)(6) (the “Crowdfunding Exemption”) of the Securities Act of 1933 (Securities Act), provide a framework for the regulation of registered funding portals and brokers, and exempt securities sold pursuant to the Crowdfunding Exemption from the registration requirements of Section 12(g) of the Securities Exchange Act of 1934 (Exchange Act).

Week in Review: SAC Insider Trading and Google’s Growth

SAC Capital Advisors has been under intense pressure from government regulators—and it appears that its chief, Stephen A. Cohen, may be ready to make a deal. Amongst the biggest provisions under negotiation on insider trading charges, as reported this week by the New York Times, is a requirement that SAC may be required to exit the investment advisor business entirely. While Cohen could still manage his personal fortune, he would not be allowed to invest with others’ money; this represents a major strategy shift for the once-famed hedge fund. What’s more, the deal will likely require SAC to admit to criminal misconduct and the parties have “agreed in principle” (according to the Huffington Post) to record-setting penalties and restitution upwards of $1 billion. The plea agreement is no yet a done-deal and either party may yet balk at the proposal, but it will represent a significant victory for the government if its goes through.

Google is on the rise once again. The dominant search-engine company’s stock traded above $1,000 per share this morning for the first time, up more than 13%. Google exceeded analysts’ expectations, reporting a 23% rise in Internet-related revenue last quarter as the company’s focus on mobile-based content and advertising proved successful. The shift towards smartphones, iPads, and tablets has pushed down cost-per-click ad revenue, but growth Google’s traffic and ad volume has ‘outpaced’ this trend according to a Reuters interview.

Week in Review: Government Shuts Down, Twitter Ramps Up

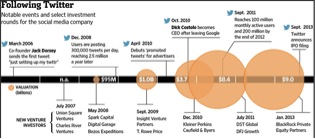

Twitter, Inc. publicly filed its IPO documents on Thursday, revealing the microblogging company’s financials for the first time. Analysts expect the seven-year-old site to be valued in the $10- to $15-billion range, although it is still unprofitable. Rapid growth has been outmatched (for now) by accelerated expenses: in the first half of this year, revenue doubled to $254 million but net loss increased by 40% to $69 million. Twitter, which has chosen the ticker symbol TWTR, is still behind the pace set by Facebook. By comparison, Facebook’s IPO sales pitch showcased a $1 billion annual profit in 2011 and 845 million active users (Twitter has 215 million). Twitter’s co-founder and former CEO Evan Williams will expect the largest payout once the liquidity event is completed; he owns 12 percent of the company. Co-founder Jack Dorsey owns 4.9 percent.

The federal government is paralyzed as lawmakers have failed to agree on the nation’s budgetary priorities. Divided government in hyper-partisan Washington, D.C., has proven to be a recipe for stalemate. While most of the coverage has focused on House Republicans’ objection to funding the Affordable Care Act, the debate will likely be viewed as a much broader battle on federal spending. Two storms will soon converge—the current battle over a Continuing Resolution (essentially legislative authorization to write certain checks from the U.S. Treasury) and the imminent necessity to raise the federal government’s $16.7 trillion debt ceiling (to further add to the nation’s debt). Treasury Secretary Jack Lew has estimated that the U.S. government will need to raise the ceiling before October 17th, less than two weeks away. For lawmakers, resolving the current shutdown by passing a “clean CR” will solve little unless the deal also addresses the debt ceiling—thus, the conversation for congressional leaders of both parties appears to have shifted to a grand bargain or large-scale budget deal. For now, Wall Street has remained mostly apathetic, but prolonged brinksmanship is likely to change the market’s attitude in a hurry.

Week in Review: JPMorgan Returns to the Hot Seat

Once again, JPMorgan found itself discussing yet another settlement and facing bad publicity linked to excessive risk-taking. Last week, news broke that the bank had agreed to a $920 million settlement in the “London Whale” derivatives trading case; plus, the Consumer Financial Protection Bureau ordered JPMorgan to refund over $300 million to customers based on alleged wrongdoing in its credit card and debt collection procedures.

Another settlement deal surfaced this week—and its numbers are much larger. The U.S. Department of Justice is seeking $11 billion (with a ‘B’) in compensation for JPMorgan’s actions leading up to the Financial Crisis, including selling mortgage backed securities the bank knew were essentially worthless. According to the Washington Post, it would be “the biggest settlement a single company has ever undertaken.” On Thursday, the bank’s visible CEO Jamie Diamond flew to Washington, D.C., to meet with Attorney General Eric Holder for nearly an hour. Instead of lobbying for looser restrictions on Wall Street, Diamond was seeking an end to federal and state probes (which still represent a large liability to the bank) and, perhaps more importantly, attempting to avoid criminal charges.

All of the rhetoric and press releases notwithstanding, the Administration’s handling of numerous JPMorgan investigations has been properly criticized for missing an opportunity to charge top Executives. The S.E.C., D.O.J., and other regulators have thus far failed to press criminal charges, even when financial disclosures have misrepresented the bank’s business or mortgage-backed products. To be sure, the government has charged front-line traders in the London Whale case, but those tasked with overseeing the bank’s actions have escaped indictment—perhaps for the very reason that Mr. Diamond is willing to personally negotiate with the nation’s top law enforcement official on their behalf.

While the financial penalties being discussed are stiff, they represent only a small fraction of the damage done to the global economy, JPMorgan shareholders, and (ultimately) dinner tables across the country. Columbia Law School professor John C. Coffee Jr. provided some insight to the back-and-forth. He told the Post: “If I was in [Holder’s] position, I would be concerned about my legacy. . . . There’s been a lot of criticism of officials in Justice being much too soft, timid.”

Stocks Hit Record High As Fed Keeps Bond Buying At $85B A Month

The Federal Reserve announced on Wednesday that it would continue its current quantitative easing policies indefinitely, despite the unanimity on Wall Street that a scale-back was imminent. This announcement sent the Dow and S&P 500 to record highs.

According to Bernanke, with the federal funds rate remaining in the 0 – 0.25% range and unable to decrease any further, the central bank’s measures to stimulate the economy have been focused on complementary methods of “asset purchases and forward guidance about short-term interest rates.” For example, in September 2012, the Federal Open Market Committee (FOMC) initiated a stimulus plan to purchase $40 billion per month in agency mortgage-backed securities in addition to the $45 billion per month in longer-term securities that it was already acquiring as part of its Maturity Extension Program (MEP). In December 2012, the Fed announced that it would maintain its $85 billion per month asset purchase program, even after the MEP had ended, by continuing to purchase $45 billion per month in longer-term Treasuries.

However, in June 2013, the Federal Reserve suggested that it would begin a modest reduction in the pace of its purchases by as early as September 2013, and possibly end the program around mid-year 2014. This caused some turmoil on Wall Street over the summer, as the markets tried to adjust to the idea of a departure from the asset purchase program, and consequently lead to a decrease in stock prices and an increase in interest rates.

City Council Votes in Richmond, CA, Mortgage Eminent Domain Proposal and UPDATE

After a seven-hour meeting that dragged into early Wednesday morning, the Richmond City Council voted 4-to-3 to continue pursuing its plan to condemn underwater mortgages using the city’s eminent domain power. The development is just the latest in an ongoing and high-stakes dispute over a novel property law argument.

Here is the background: The city of Richmond, California, has long-faced deteriorating property values. Once a shipbuilding powerhouse for the U.S. Navy during World War II, the region’s declining industrial based has hit Richmond particularly hard. City leaders have struggled to attract redevelopment capital, as businesses have largely opted for other booming Bay Area locations. And when the mortgage crisis hit, Richmond’s communities experienced rampant foreclosures.

In response, the City has considered a novel move: mortgage condemnations through the power of eminent domain. That is, the City’s proposl would condemn the underwater mortgage obligations, but not the real estate itself. If implemented, banks would be forced to write down large portions of a borrower’s principal. The Network has previously covered the mortgage eminent domain proposal and Mortgage Resolution Partners, which had backed Richmond’s plan. And last September, the Berkeley Center for Law, Business and the Economy and Berkeley Business Law Journal hosted Adjunct Professor Bill Falik—who is a partner at MRP—to discuss the innovative (though controversial) scheme. The Network covered counterarguments as well.