On November 4th, 2013, BlackBerry announced that it would forgo its plan to sell its business. Instead, the company has decided to replace its CEO Thorsten Heins and obtain a $1 billion cash injection from private placement of convertible debentures. The news was followed by another plunge of BlackBerry’s share price – it dropped 16.4% to a price of $6.49, well below the buyout price of $9 a share offered by Fairfax earlier this year. Has the former phone giant lost yet another battle?

M&A Revisited: BlackBerry Abandons Sales Plan, Looks Towards Future

High Tide Warning in Global Shareholder Activism

In its new report titled “Rising Tide of Global Shareholder Activism,” the Financial Strategy and Solutions Group of Citi observes that shareholder activism has spread to companies in all sectors, of all sizes and across all geographic regions.

As the report suggests, activist hedge funds have accumulated their funds and, in order to put this financial firepower to work, are exporting their activism abroad. On the so-called “supply side” of the phenomenon, shareholder interventions are increasingly encouraged by the presence of undervalued targets with conservative financial strategies and a lack of top-line growth, dispersed share ownership, and reforms that enhance shareholder rights.

Selling Your Company: Deal Structure to Unlock Additional Value

Most sellers know that preparing for a sale requires certain homework, such as cleaning up business and corporate records, and considering key employee retention arrangements. Another important way to prepare for a sale is to be ready to negotiate deal structure.

IPO Alert: Chinese Internet Behemoth Alibaba plans IPO in the U.S.

After a period of breathtaking growth, China’s biggest e-commerce company, Alibaba, has recently planned its initial public offering. Now the two major U.S. stock exchanges are ready to fight for the right to host. Though it has not been announced yet, Alibaba’s plan to raise $10 to $15 billion will likely overshadow Twitter’s highly anticipated Nov. 15 listing on the New York Stock Exchange. Relatively loose regulations in the United States, in contrast to Hong Kong’s stringent regulations, may be the fundamental factor that contributes to the biggest IPO since Facebook’s rocky debut last year.

Tomorrow’s Fantasy Football: Owning Stock in Players

A San Francisco-based startup has created a new financial product that may push sports betting to a new level, challenging regulators and existing law.

Fantex, Inc. wants you to buy stock in Arian Foster, the Houston Texan’s Running Back. As an investor, you can receive up to 20% of Foster’s future earnings from his playing contracts, endorsement deals, broadcasting contracts, or any other income that he receives from contracts attributed to his brand.

JPMorgan Chase Suffers First Quarterly Loss Under CEO Jamie Dimon

Due in large part to the $9.2 billion it set aside to cover mounting legal expenses, JPMorgan Chase, the nation’s largest bank, suffered its first quarterly loss under CEO Jamie Dimon. JPMorgan reported a loss of $380 million, or 17 cents per share for the third quarter, compared with a profit of $5.71 billion, or $1.40 per share just a year earlier. This cast a somber tone for the unusually humble Dimon, stating that the loss was “very painful for me personally.”

From the Bench: No Fiduciary Duties Between Two Equal 50% Shareholders

Maurer v. Maurer, 2013 NCBC 44, is a continuation of several Business Court opinions (2005 NCBC 1, 2005 NCBC 4, and 2006 NCBC 1), which involves extensive litigation between Jill L. Maurer (“Ms. Maurer”) and SlickEdit Inc., a software corporation owned by her and her husband, Joseph Clark Maurer (“Mr. Maurer”). In Maurer v. Maurer, a North Carolina superior court found that there is no special fiduciary duty in favor of one fifty percent owner against a fellow fifty percent owner who has effective control.

The allegations arose after the conversion of SlickEdit Inc., into a Subchapter “S” corporation in May 2008. Ms. Maurer and Mr. Maurer, former spouses, each held fifty percent of issued and outstanding shares in the corporation. Ms. Maurer brought individual claim action for breach of fiduciary duties against Mr. Maurer, the sole director, Chief Executive Officer, President and Corporate Secretary of SlickEdit Inc. She alleged that Mr. Maurer abused his control by operating and implementing an overall system designed to exclude her from any knowledge of or participation in corporate affairs despite her equal ownership in the corporation. The Amended Complaint included, inter alia, allegations that Ms. Maurer was precluded from voting in a fair election of directorsand that she had been denied access to details of SlickEdit’s plans, operations, and financials and other corporate books and records.

In an “unprecedented” case, the issue before the court was whether it could extend the line of appellate cases to impose a fiduciary duty in favor of one fifty percent owner against the other fifty percent owner who had effective control.

U.K. Files Suit Over Banker Bonus Caps

Britain, home of Europe’s biggest financial center, is challenging a recent decision by European lawmakers to begin capping banker’s bonuses in 2014. The cap affects bankers with a salary of 500,000 euros a year or more. Bonuses would be limited to a banker’s fixed pay, or twice that amount with the approval of a majority of the shareholders.

The British Banker’s Association, which requested the caps on bonuses be postponed, projected that about 35,000 bank employees around the world would be affected by the new rules—the vast majority located in London.

In response to widespread public anger over the financial crisis, European legislators moved to rein in outsize banker’s bonuses with the proposed cap. A spokesman for the Treasury objected to the cap, saying that it will actually push banker’s fixed pay upward, ultimately making the banking system riskier and failing in the original objective of limiting banker’s compensation. Britain has also repeatedly warned that tighter regulation could push banks toward moving their business to the U.S. or Asia.

Week in Review: Government Shuts Down, Twitter Ramps Up

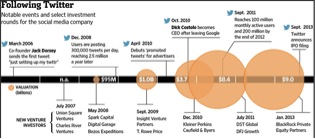

Twitter, Inc. publicly filed its IPO documents on Thursday, revealing the microblogging company’s financials for the first time. Analysts expect the seven-year-old site to be valued in the $10- to $15-billion range, although it is still unprofitable. Rapid growth has been outmatched (for now) by accelerated expenses: in the first half of this year, revenue doubled to $254 million but net loss increased by 40% to $69 million. Twitter, which has chosen the ticker symbol TWTR, is still behind the pace set by Facebook. By comparison, Facebook’s IPO sales pitch showcased a $1 billion annual profit in 2011 and 845 million active users (Twitter has 215 million). Twitter’s co-founder and former CEO Evan Williams will expect the largest payout once the liquidity event is completed; he owns 12 percent of the company. Co-founder Jack Dorsey owns 4.9 percent.

The federal government is paralyzed as lawmakers have failed to agree on the nation’s budgetary priorities. Divided government in hyper-partisan Washington, D.C., has proven to be a recipe for stalemate. While most of the coverage has focused on House Republicans’ objection to funding the Affordable Care Act, the debate will likely be viewed as a much broader battle on federal spending. Two storms will soon converge—the current battle over a Continuing Resolution (essentially legislative authorization to write certain checks from the U.S. Treasury) and the imminent necessity to raise the federal government’s $16.7 trillion debt ceiling (to further add to the nation’s debt). Treasury Secretary Jack Lew has estimated that the U.S. government will need to raise the ceiling before October 17th, less than two weeks away. For lawmakers, resolving the current shutdown by passing a “clean CR” will solve little unless the deal also addresses the debt ceiling—thus, the conversation for congressional leaders of both parties appears to have shifted to a grand bargain or large-scale budget deal. For now, Wall Street has remained mostly apathetic, but prolonged brinksmanship is likely to change the market’s attitude in a hurry.

Nokia’s Misleading Information about CEO Compensation Means Windfall for Elop

One of the biggest recent deals in the mobile phone market reveals a curious case of misleading information about Nokia’s former Chief Executive Officer, Stephen Elop, and Microsoft’s “acquisition” of its possible future CEO.

Nokia’s Chairman Risto Siilasmaa announced that Mr. Elop’s service contract with Nokia had “essentially the same” bonus structure as the one of its previous CEO. However, the Finnish Newspaper “Helsingin Sanomat” searched SEC filings and uncovered evidence that fundamental changes to the referred service contract were implemented in 2010.

As a result, Mr. Siilasmaa was later forced to correct the previous information and announced that Mr. Elop’s contract also contained an immediate share price performance bonus, which would be paid in case of a “change of control” situation.

The chain of events that would trigger Mr. Elop’s payout seemed unlikely to happen at the time of the change in his contract. Microsoft’s €5.44billion purchase of Nokia mobile phone business changed this scenario. The deal triggered the “change of control situation” in Mr. Elop’s contract, entitling him to a payout of approximately US$25million.