In early December, two Wall Street giants, Goldman Sachs and JP Morgan Chase, finally satisfied the Federal Reserve’s stiffer requirement with improved capital plans. The banks successfully put the matter behind them by resubmitting capital plans after the regulators found “significant weaknesses” in the ones submitted in March during a stress test. “We are pleased that the Fed determined” the bank’s stress test “process improvements met their expectations,” JPMorgan’s chief executive Jamie Dimon said in a statement.

The Volcker Rule: Impact on Banking Entities’ Investments in Trust Preferred CDOs

On December 10, 2013, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System, the Securities and Exchange Commission, and the Commodity Futures Trading Commission released final rules (the Final Rules) to implement Section 619 of the Dodd-Frank Wall Street and Consumer Protection Act, commonly known as the “Volcker Rule.”

Law360: Inside EU Rule On Acquisitions Of Minority Shareholdings

In June 2013, the European Commission launched a consultation on its proposed reform of the EU Merger Regulation (EUMR), which included a proposal to extend the scope of the EUMR to cover acquisitions of noncontrolling shareholdings between undertakings. The consultation closed in September 2013. This article provides an overview of the commission’s proposal and the issues raised by the consultation, and sets out next steps in the legislative process.

Contemplating IRS Safe Harbor for Rehabilitation Credits and its Impact on the Energy Investment Tax Credit

The IRS recently issued Revenue Procedure 2014-12, providing a safe harbor under which the IRS will not challenge partnership allocations of “section 47” federal rehabilitation tax credits. In the aftermath of the IRS’s win in Historic Boardwalk Hall, LLC v. Commissioner, the Revenue Procedure is intended to provide more predictability regarding the allocation of section 47 rehabilitation credits to partners of partnerships that rehabilitate certified historic structures and other qualified rehabilitated buildings.

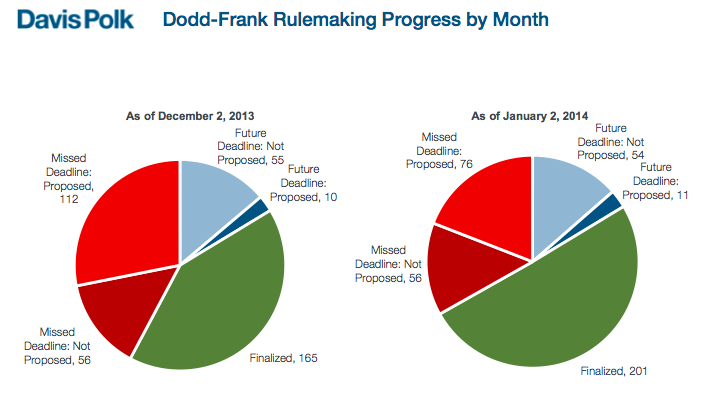

Dodd-Frank Progress Report

Risk-transfer Deals Pose Roadblocks to Federal Reserve’s New Minimum Liquidity Proposal

As banks structure deals to circumvent the Federal Reserve System’s new liquidity coverage ratio proposal (‘LCR’), regulators scramble to protect the financial industry from another fiscal meltdown.

Transaction Advisers: Amendments to Delaware Law to Facilitate Short-Form Mergers in Two-Step Transactions

Acquisitions often employ a two-step structure in which the acquiror first launches a tender or exchange offer for any and all outstanding shares. Upon the close of the tender or exchange offer, the acquiror then acquires any shares not tendered in the offer by way of a second-step merger to complete the acquisition.

Volcker Rule challenged in Court: Will Regulators Accede or Demur?

The American Banker’s Association (ABA) filed a petition on December 24, 2013, in the United States Court of Appeals for the District of Columbia challenging a provision of the recently approved final version of the Volcker Rule (the Final Rule) requiring community banks to divest their holdings in a commonly held debt instrument known as Collateralized Debt Obligation backed by Trust-Preferred Securities or TruPS-backed CDO.

2013: The Year of Corporate Venture Capital

Corporate venture capital on the rise

Looking back, 2013 has been the year of corporate venture capital (CVC). Corporate venture capital is a special form of investment of corporate funds directly in external target start-up companies. Corporations decide to pursue CVC projects not only for financial reasons, but also to create a ‘window on technology’, which enables them to early spot and follow innovations.

Corporations have realized that pumping millions of dollars into R&D projects might not be the best way to keep pace in their industries. The fall of tech giants like Kodak and Nokia, who did not sense the winds of innovation, are evidence of the failure of traditional R&D investment. Nowadays, there is another way for corporations to innovate and generate profits at the same time – by becoming active participants in the startup game.

SEC Issues New Guidance On “Bad Actor” Disqualification From Rule 506 Offerings

On December 4, 2013, the staff of the Securities and Exchange Commission (SEC) Division of Corporation Finance issued new guidance regarding the “bad actor” disqualification provisions of Rule 506(d) of Regulation D under the Securities Act of 1933 (Securities Act) and the related disclosure requirements of Rule 506(e) through an update to its Securities Act Rules Compliance and Disclosure Interpretations (C&DIs). The 14 new CD&Is provide important clarification to the final rules approved by the SEC earlier this year and additional guidance to issuers seeking to comply with the new requirements of Rules 506(d) and 506(e) of Regulation D under the Securities Act. This advisory summarizes some of the more significant of these new CD&Is.

Click here to read the entire Advisory.